Among the foremost obligations that Allah SWT has placed upon every Muslim, after Tawheed and Salah, is Zakat. Zakat. is the third pillar of Islam. That’s what we have been hearing and learning since childhood, right?

But, often, as we move into adulthood and start earning and accumulating wealth, or at times, inheriting it, we find ourselves in a confused state. A series of questions start buzzing in our minds; is Zakat obligatory on me yet? How do I pay my Zakat? When do I pay it? On what assets does Zakat apply? To whom should I give my Zakat? And on and on it goes.

Some flying information here and some random piece of knowledge there, that’s all we mostly know about this very significant duty of ours. But, is that how it should be? You bet not.

For this very reason, I have compiled here for you all the bare essential information you need to know about Zakat.

But before we begin, remember this: Zakat is an Ibadah, and the entire time that you engage in learning how to do any Ibadah counts as Ibadah itself, with the right intention! So, renew your intention and earn rewards as you read through this article. Cool, right?

Now, let’s get moving towards our comprehensive guide to Zakat.

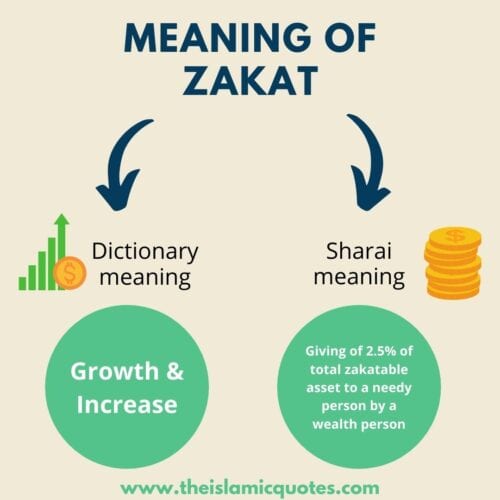

1. What Does the Word Zakat Mean?

By dictionary, the word Zakat comes in two different meanings. One of growth and increase, and the second of purification.

However, according to the Quran and Sunnah, Zakat refers to ‘giving ownership of a specific portion of your specific wealth to a specific person for Allah SWT according to the guidelines of Shariah.’

This can sound a bit hefty. But, don’t worry. As you read ahead, all the knots will fall into place. And if you want to learn more, I highly recommend going through our previous post: Islamic Quotes on Charity.

2. History of Zakat

The obligation of Zakat goes beyond the Shariah of Muhammad (peace be upon him). Like Salah, it existed in the law of the previous Prophets as well. This is evident from many Quranic verses.

During the time of our Prophet Peace be upon him, Zakat became compulsory only in the second year of Hijrah.

Just as many laws were sent down after the Hijrah, so were the rulings of Zakat.

And thus, it is since then that Zakat has remained obligatory upon Muslims with certain conditions.

Zakat has been mentioned in the Quran close to 82 times. There is great reward in paying Zakat properly, fulling all conditions. And likewise, there is severe punishment mentioned in the Quran and Hadith for those who do not pay Zakat despite the obligation.

Hence, we must understand Zakat well.

3. Zakat Rules

Now, as mentioned in the Sharai definition of Zakat, there are numerous aspects to Zakat.

These are:

- Rules about the payer

- Rules about the wealth (Nisaab)

- Rules about calculating Zakat

- Rules about the receivers of Zakat

- A few essential rules concerning Zakat

All these aspects have specific details; let’s take a closer look to understand each.

3.1 Upon Whom Is Zakat Fardh?

There are two categories of conditions: the characteristics of the individual or payer and the characteristics of the asset. When both elements/conditions are met, Zakat becomes obligatory upon a certain individual.

Characteristics of the Individual

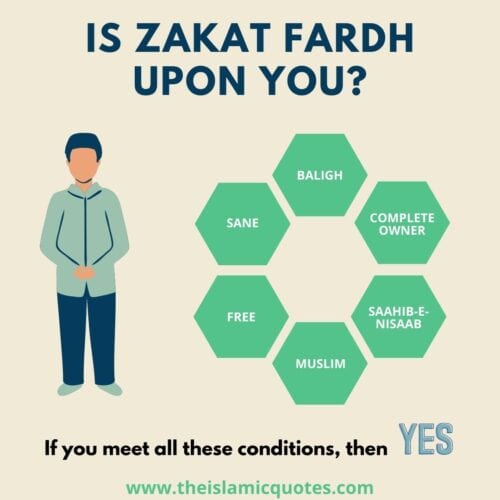

For an individual to be liable for Zakat, he needs to be a:

- Muslim

- Free

- Sane

- Major (Baligh, having reached or crossed puberty)

- Saahib-e-Nisaab (the individual owns assets equal to the value of Nisaab. The details of Nisaab are coming ahead)

- Complete ownership of the asset. This means that not only the person owns the wealth but also possesses it. (Consider the indebted person who possesses the asset but doesn’t own it. This wealth isn’t liable for Zakat)

Characteristics of the Asset

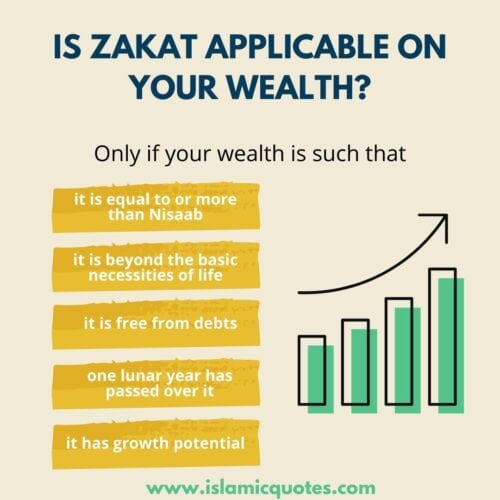

For an individual to be liable for Zakat, he should have assets with the following characteristics:

- They should be equal to or more than Nisaab. Thus, assets that are below the level of Nisaab are not levied for Zakat.

- They should be excess of basic necessities of life. The wealth used to fulfill the needs of life is not Zakat-liable wealth, such as clothes, kitchenware, furniture, etc.

- They should be free from debts.

- A complete lunar year must have elapsed over them.

- They should have growth potential. The word Zakat itself means ‘growth’ as mentioned earlier. (More detail coming in Zakatable assets)

Thus, when an individual fulfills the required conditions and has assets that meet the mentioned conditions, he is now liable to pay Zakat.

3.2 What is Nisaab?

Since childhood, we have been learning the numbers 52.5 Tola and 7.5 Tola and the famous number 2.5%. What are these numbers, and how do they come into play? Let’s understand.

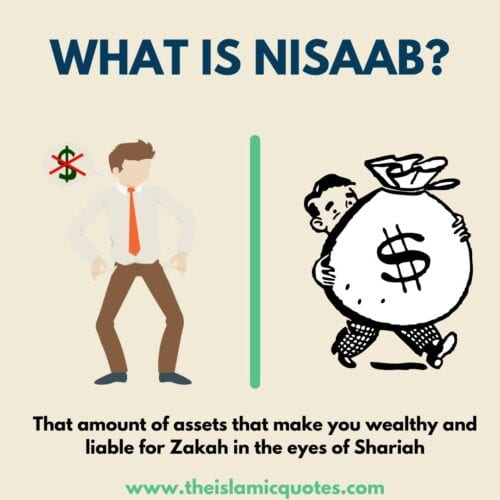

Nisaab is essentially the boundary line or the threshold, which creates the clear-cut distinction between those who are liable to pay Zakat and those who are not.

It is the minimum wealth you must have before the obligation of Zakat applies to you. An owner of Nisaab is considered rich and wealthy in terms of Shariah. He is referred to as Saahib-e-Nisaab, meaning the ‘owner of Nisaab/owner of wealth equivalent to Nisaab’

However, note that Nisaab is only considered for Zakatable assets and not every wealth you own falls under that. For our ease, Shariah has specified a few.

Zakatable Assets

Zakat only applies to assets that have growth potential.

For this reason, a table you have for personal use is not Zakatable. But, if you own the same table for trade, it becomes Zakatable. Because now, you can grow your wealth through that one table.

The same applies to gold and silver. The current value of your gold won’t be the same a few years or even months later. By the tradition of the curve, the value increases.

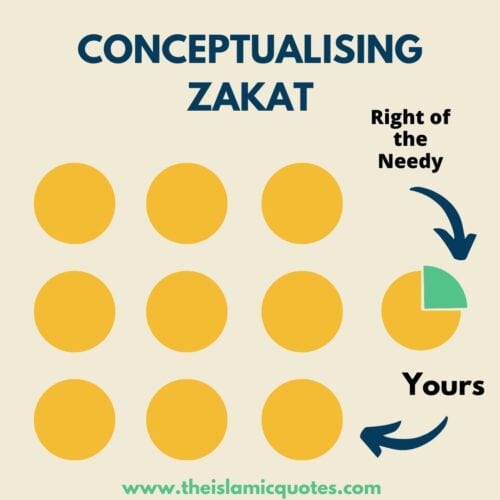

This shows us that Zakat is not meant to reduce our wealth; it’s there to help it grow more. When you give Zakat, your wealth becomes purer, more prone to barakah, and more beneficial to you and others.

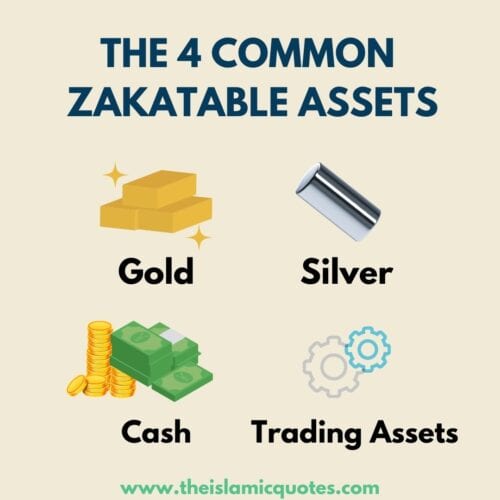

So, the growth-friendly assets that we possess, also known as Zakatable assets, are classified as:

- Trading assets

- Cash and the equivalents of cash (such as prize bonds, etc.)

- Gold

- Silver

- Livestock (goats, cows, etc.)

- Agricultural output

Now, the commoner, such as you and me, most commonly possess four of these things; trading assets, gold, silver, and cash (the first four categories). For this reason, we will only be looking at these in detail in this article.

Nisaab of Zakatable Assets

From all that we have established above, it is clear that to be liable for Zakat, you need to have Zakatable assets equalling the value of Nisaab.

What is the Nisaab amount? Let’s break it down to understand.

- For gold, the Nisaab is 7.5 Tolas. This means that if you only possess gold and absolutely nothing else from the Zakatable assets (not even a single penny), then you ought to have 7.5 Tolas of gold to become liable for Zakat.

- For silver, the Nisaab is 52.5 Tolas. Again, this implies that if you only have silver and nothing else, you ought to have 52.5 tolas (or 613.35 grams) of silver to be liable for Zakat payment.

These are the primary Nisaab. The Nisaab for cash and trading assets are explained in terms of the Nisaab for silver.

- For trading assets, if the total value of your trading assets reach the value equivalent to 613.35 grams of silver, you will be considered to have reached the Nisaab of trading assets. For example, you own a clothes business, and the goods that you currently have are worth equal to 613.35 grams of silver. In this case, you are liable for Zakat and you ought to pay 2.5% of the total current value of your goods.

- For cash, if the total value becomes equal to or more than 613.35 grams (52.5 Tolas) of silver, then you have reached the Nisaab.

However, commonly, we Muslims don’t solely own any single Zakatable asset. We often have any 2, 3, or maybe all 4 of them. What is the Nisaab then?

Well, it’s pretty simple. If you have more than one zakatable asset, you find out the total value of all of them combined and see if the total value reaches 613.35 grams of silver. If it does, then Zakat applies. If it doesn’t, then Zakat doesn’t apply. (More coming below)

4. How to calculate Zakat?

Calculating Zakat is pretty easy if you’ve done all the homework before it.

One of the essential things to know when calculating and paying your Zakat is knowing and identifying the date when you became Saahib-e-Nisaab.

Knowing your Zakat Date

The date on which you become Saahib-e-Nisaab is when you become the owner of total zakatable assets, such that their real value equals or rises above the value of 613.35 grams of silver.

This date is crucial because on this very same date, a year later, you will be liable to pay Zakat.

Note that this date is supposed to be in the lunar calendar.

For example, suppose you became Saahib-e-Nisaab on 3rd Muharram 1440. Then, on 3rd Muharram 1441, you will become liable for Zakat if you still own assets equal to or more than the Nisaab. Before the date, the obligation of Zakat wouldn’t apply to you.

Thus, knowing your date is essential because rates fluctuate every day, and if you don’t know your date, you can’t tell when you need to calculate your Zakat.

The Actual Calculation

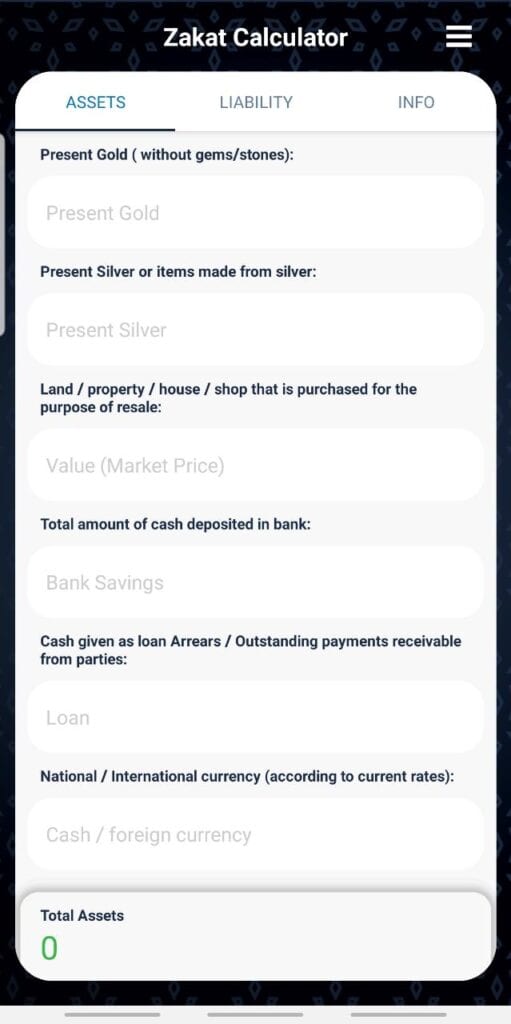

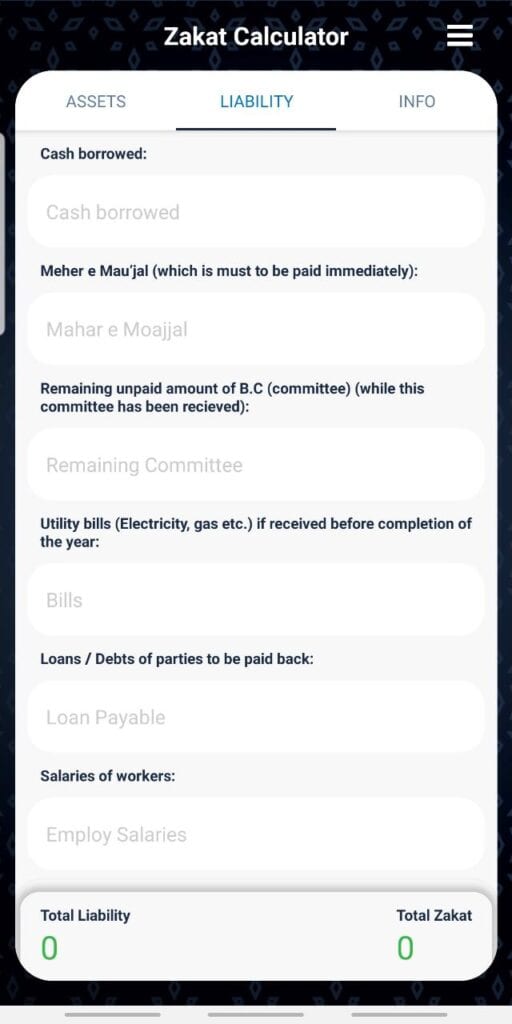

So, now that we’ve done all the homework, let’s move towards the actual calculation. Follow the steps below to calculate your Zakat:

Remember, you are doing all of this on your Zakat date.

- Identify all your Zakatable assets. (Do I have gold, silver, cash, and trading assets?)

- Find out the total amount of each asset. (E.g., 10 grams of gold, two tolas of silver, 35$, etc.) For gold and silver, it is best to stick to one unit, either tola or grams.

- For gold, know the karat. Is your gold at 18K, 21k, 22k, or 24k? You might need to ask around a bit or dig in receipts to extract the information.

- Now, find the current rate of gold and silver for your country and city. You can use Google or a local newspaper for that.

- Next, find out the total value of your gold and silver. (Total amount × current rate)

- With that done, you need to know the Nisaab. Using the rate you found of silver, calculate the Nisaab (52.5 tolas or 613.35 grams of silver)

- Next, combine the value of all your zakatable assets.

- Now see if the total amount reaches the value of Nisaab. Remember, if you have more than one asset, the Nisaab is worth 52.5 tolas of silver. If you only have gold and nothing else, the Nisaab is 7.5 tolas of gold. So, assess your situation accordingly.

- Now, if anyone owes you money, add that to the total amount.

- Next, deduct amounts that you owe to other people (loans). Also, deduct any pending payment from your end (bills, previous Zakat, etc.)

- Whatever you have left is now your total wealth. Find 2.5% of it.

- This is the Zakat you have to pay! You can round it off to the nearest 100 or 1000.

And, that’s about it. It can sound a bit complicated but trust me; it’s a lot easier than all the differentiation and trigonometry we studied. If you could do that, you can surely do this.

Case Study on Calculation of Zakat

Let’s understand this better using a case study.

A woman named Ms. Y got married on 20th March 2020. Upon her marriage, she received many gifts, including clothes, kitchen utensils, furniture, and jewelry ( gold, silver, and diamond). She also received $3000 in cash. She is a resident of Florida, USA.

She currently does a small-scale business of selling clothes alongside managing her studies and home.

Y realizes that the following year, she will need to pay Zakat on her assets. She has asked us to calculate her Zakat. So, how should we go about it? Let’s see.

- We will first identify the date. 20th March 2020 corresponds to 25th Rajab 1441 according to the Hijri calendar. So, 25 Rajab is Y’s Zakat date on which she will become liable to pay Zakat every year.

- Next, we will see on which solar date the 25th of Rajab falls in 2021 (1442 Hijri). We find it to be on 9th March 2021. This is when Zakat must be paid by Y in 2021.

- Now, we identify all her Zakatable assets on 9th March 2021. Recall that Zakatable assets are only four: gold, silver, cash, and trading assets. As we can see, Y has gold, silver, possibly cash, and trading assets (the clothes she sells, not her personal clothes)

- We will next identify the total amount of her Zakatable assets. Upon asking, Y tells us she has five tolas of gold, 20 grams of silver, $3500 in hand, and her trading assets are worth $5000.

- We next ask her the karat of her gold, she tells us it’s 24k.

- Now, we will calculate the total worth of her gold jewelry. So, we find out the rate of 24k gold for 9th March in dollars. Let’s say it is 660$ per tola, which means five tolas of gold will be worth 660 x 5 = 3300$

- Next, we will calculate the total value of her silver jewelry. On 9th March 2021, let’s assume that silver was priced at 8.5$ per 10 grams. So, her entire silver jewelry will be worth 20 × 8.5 = 170$.

- Now, we will sum up her total assets:

Gold = $3300

Silver = $170

Cash = $3500

Trading assets = $5000

Sum = 11970

- Now, let’s check if she has any receivables? Y tells us she has receivables worth $630. Add that and the sum is $12,600.

- Next, we will ask her if there are any payables due on her. She tells us payables are worth $600. We will subtract the payables. We are now left with $12,000.

- The next step is to figure out if her total assets reach the value of Nisaab. To figure out Nisaab, we will find the value of 613.35 grams of silver.

10 grams = $8.5

613.35 grams = $521.3475

- Indeed, Y’s assets are more than the Nisaab. So Zakat applies to her, she is Saahib-e-Nisaab.

- Now, the last bit is calculating 2.5% of her total assets. (2.5÷100) x 12,600 = $315.

Hence, Y has to pay a Zakat of $315 on 9th March 2021.

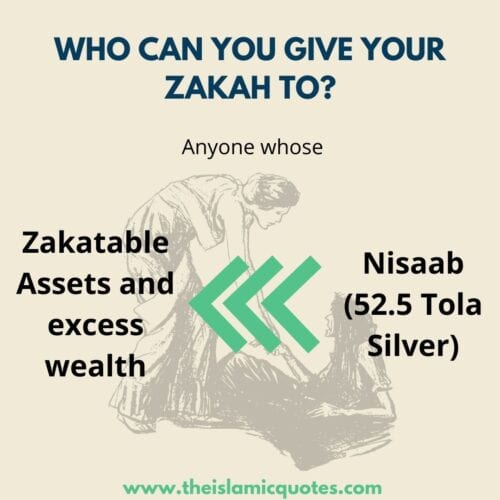

5. Who to pay your Zakat to?

With the Zakat calculation done, you now need to see who to pay Zakat to.

For a person to be eligible to receive Zakat, he should fall in either of these categories:

- He doesn’t possess any property or assets at all.

- He owns only the minimum basic necessities of life (basic furniture, kitchen utensils, clothes, conveyance, house, tools of trade, electronics of need).

- He owns assets beyond the necessities, but the combined value of excess is less than the value of Nisaab.

All three categories are impoverished people who are eligible to receive Zakat.

However, you should also remember that the recipient of Zakat should not be a Syed (from the descendants of the Prophet, peace be upon him).

6. Some Misconceptions About Zakat

- Zakat can only be paid in Ramadan.

False. Zakat becomes obligatory when one year elapses after a person becomes Saahib-e-Nisaab. For each person, the date is different. However, Zakat can be given earlier in Ramadan if one’s date doesn’t fall in Ramadan. Most people prefer to take out in Ramadan for increased rewards and to help the poor. But it isn’t obligatory.

- Zakat is only on gold.

False. Zakat is on all zakatable assets mentioned above (gold, silver, cash, trading assets), agriculture output, and livestock.

- Cash or gold that is saved for marriage, or Hajj, or other purposes is not zakatable.

Also false. All cash on the date of Zakat is zakatable, as long as it is not used for necessities of life.

- Zakat can also purify wealth earned through interest.

Haram wealth remains haram, unblessed and sinful no matter how much charity is given from it.

- The Zakat on a wife’s jewelry needs to be paid by the husband.

Absolutely not. Every Muslim is responsible for paying his/her own Zakat. If a husband pays his wife’s Zakat, it will be counted as Ihsaan (additional good deed).

7. Some Important Pointers to Know About Zakat

- Trading assets are goods that are bought with the intention of sale and the intention to sell is still present at the date of Zakat.

- A full year does not need to pass on every item. Assets acquired during the year will also be counted when calculating Zakah at the end of one year.

- Making the recipient complete owner is essential for Zakat to discharge

- Intention (niyyah) is crucial in Zakat; it does not take place without it.

- Zakat is not payable on jewels, gems, other metals, diamonds, rubies, etc., if not acquired for trade.

- Zakat can be paid before the completion of a year. However, on one’s date of Zakat, one would need to recalculate his Zakat and pay whatever’s left, if any.

- Does Zakat apply only to that gold or silver which is not for personal use? According to Imam Abu Hanifa (RH), gold and silver are zakatable assets in all shapes, sizes, and forms, even if they are in personal use. According to Imam Shafai, Imam Ahmad bin Hanbal and Imam Malik, Zakat does not apply to gold and silver jewelry in personal use.

8. Some Tips to Ease the Zakat Process

Calculating and discharging Zakat can be a tiresome process, but Allah SWT makes it easy for those who do to please Him and fulfill His obligations. Here are some tips you can follow to make your Zakat process smooth.

- You don’t need to dispense off your Zakat in one go. You can set aside and give a certain amount every month so by the end of the year you aren’t burdened

- You can use an authentic online Zakat calculator to help you. Here is one we like!

- Try to have all your Zakat calculations and dates written. It would relieve you of the mental pressure

- Instead of 2.5%, scholars recommend giving 3-5% as an expression of gratitude to Allah SWT and compensation for any errors we might have made during the process

- Better not to do all the calculations alone. Two or three wise people involved would make the hefty process easy and more likely to be free of errors.

9. Islamic Quotes On Zakat

Here’s a collection of some authentic quotes on Zakat from Quran and Sunnah along with some beautiful words of wisdoms from our scholars and sahaba.

9.1 – Zakat Quotes from Quran

9.2 – Hadith on Zakat

9.3 – Zakat Quotes from Sahaba & Scholars

Final Words

With that, we come to conclude all our basic knowledge about Zakat. If you wish to learn in more detail, you may read here.

Lastly, often as we calculate our Zakat, we feel a bit uneasy thinking there’s such a huge amount to be given. At that moment, take a moment to remember that 97.5% of your wealth is all yours, still yours, purely yours. So, enjoy the blessings and barakah of your purified wealth!